The Future of AI in Software Development: Tools, Risks, and Evolving Roles

Learn how AI in software development affects developer roles, productivity, security risks, and the skills employers want now.

If you’re thinking about graduate school for software development you’ve probably had the same nagging thought as a lot of working developers and career changers: Am I investing in a field that AI is about to shrink? It’s a fair concern, especially when headlines make it sound like code writes itself and whole applications appear from a prompt.

Software development careers have always been shaped by moments like this, when new capabilities force the field to reconsider what expertise actually looks like. AI introduces that kind of moment by shifting where skill and responsibility show up in the work, which makes questions about education, career paths, and long-term value worth examining.

“The most significant change in AI is the ease of access to Gen AI tools to regular users,” says Interim Dean Li-Chiou Chen of Pace’s Seidenberg School of Computer Science and Information Systems. “That is, everyone with internet access can use AI tools to some extent. Therefore, AI is impacting every aspect of our lives and is helping us make decisions in many areas, such as healthcare, communications, education, legal, marketing, and more.”

That accessibility is reshaping what it means to work in software. To understand where the field is headed, it helps to look at how AI is already changing day-to-day development work.

How Has AI Helped Transform the Role of Software Developers?

AI has changed how work is distributed across projects. Tasks that used to absorb large amounts of time now move faster, which shifts how engineers approach design, implementation, and review.

In day-to-day workflows, AI-assisted systems often support routine development work by:

- Generating first drafts of code that can be reviewed and refined

- Reducing time spent on boilerplate setup and common patterns

- Suggesting fixes or improvements during implementation

- Producing images, icons, and visual assets from text descriptions

Testing and quality assurance have shifted in similar ways. AI systems can analyze codebases for patterns associated with defects or failures, which changes how teams approach coverage and validation.

Common uses include:

- Automatically generating test cases from existing code

- Surfacing edge cases that are easy to miss in manual testing

- Flagging higher-risk areas earlier in the development cycle

Security and reliability benefit from related analysis. AI-driven scanning can flag anomalies and potential vulnerabilities, helping teams focus review time where it matters most. These systems don’t replace secure coding practices, but they can help teams catch issues sooner, especially in large codebases.

Dr. Christelle Scharff, professor of computer science and co-director of the Pace AI Lab, sees this shift as part of a broader pattern, explaining, “Everybody will have to be able to use AI and this will be a differentiator. Large Language Models and image generators will permit professionals to be more productive and be used as supportive tools in all possible sectors.”

Across these use cases, AI primarily handles pattern recognition and repetition. Developers remain responsible for correctness, tradeoffs, and ensuring systems behave as expected in production.

How AI Helps Increase Efficiency Across the Software Development Process

AI’s impact shows up most clearly through efficiency gains. By reducing friction in common tasks, AI-assisted systems can help teams maintain momentum across planning, building, and review. In one GitHub survey, 70 percent of developers said AI coding tools would give them an advantage at work.

Early-stage development is where many teams feel the difference first. AI tools are often used to get features or components off the ground faster, including:

- Producing initial code drafts that can be adapted to project needs

- Filling in standard patterns without manual setup

- Moving from idea to working example more efficiently

AI support can extend into design and interface work at a basic level. When tools generate initial layouts or page structures, designers and engineers can focus more attention on interaction, usability, and refinement instead of building everything from scratch.

As projects grow, efficiency gains continue through analysis and maintenance. AI-driven scanning can help identify duplicated logic, performance issues, or refactoring opportunities across large codebases. Instead of searching manually, teams receive targeted suggestions to support maintainability work.

Natural language interfaces can speed up implementation, too. Developers describe desired behavior in plain language and receive relevant code suggestions, reducing context switching. Related techniques assist with debugging by flagging likely sources of errors and prioritizing issues based on past patterns.

In collaborative environments, these efficiencies can support steadier delivery. AI tools may help draft pull requests, summarize changes, and support reviews, all of which are useful when code volume increases and review bandwidth gets tight.

5 AI Tools That Help Software Developers

AI tools are now part of many standard development environments. Each tends to support a specific part of the workflow, and their value depends on fit and oversight.

1. GitHub Copilot

Developed by GitHub in collaboration with OpenAI, GitHub Copilot provides inline code suggestions based on context within an editor.

- How it helps:

- Generates drafts of functions and common patterns

- Reduces time spent on boilerplate and repetitive syntax

- Supports multiple languages and frameworks

- Pros:

- Deep integration with popular IDEs

- Useful for accelerating routine coding tasks

- Cons:

- Output requires careful review

- Less effective in highly domain-specific codebases

2. Claude AI

Claude AI, developed by Anthropic, is a conversational AI assistant that supports software development through code generation, explanation, debugging, and document analysis.

- How it helps:

- Generates, reviews, and explains code across multiple languages

- Assists with architecture decisions, documentation, and technical writing

- Handles long-context inputs, which is useful for analyzing large files or complex requirements

- Pros:

- Strong reasoning and explanation capabilities

- Useful for both code tasks and broader technical problem-solving

- Cons:

- Operates as a conversational tool rather than an IDE plugin

- Responses benefit from clear, specific prompts for technical tasks

3. Amazon CodeWhisperer

Amazon CodeWhisperer provides real-time code suggestions inside IDEs, with an emphasis on cloud-based development.

- How it helps:

- Assists with writing cloud services and integrations

- Flags potential security issues during development

- Pros:

- Strong support for AWS workflows

- Built-in security scanning

- Cons:

- Suited primarily for teams using AWS

- Less flexible for non-cloud projects

4. Perplexity

Perplexity is an AI-powered research and answer engine that combines large language model capabilities with real-time web search, which makes it useful for developers who need up-to-date technical information.

- How it helps:

- Quickly surfaces documentation, tutorials, and technical references with source citations

- Answers implementation questions with current information rather than relying on static training data

- Supports research on unfamiliar libraries, APIs, or frameworks

- Pros:

- Combines conversational AI with live web search for current results

- Cites sources directly, making it easier to verify information

- Cons:

- Not designed for direct code generation inside an IDE

- Output depends on the quality and availability of indexed sources

5. Qodo

Qodo (formerly CodiumAI) is an AI-powered code review tool that analyzes changes in real time to identify bugs, logic issues, and quality concerns before code is merged.

- How it helps:

- Flags potential errors and inconsistencies during development

- Reviews pull requests to surface higher-risk changes

- Supports automated quality checks across codebases

- Pros:

- Improves code quality early in the workflow

- Useful for scaling review across larger projects

- Cons:

- Requires configuration to match team standards

- Still depends on human review for final decisions

What Are the Risks of Using AI in Software Development?

AI tools can improve speed and reduce friction, but they also introduce risks that teams need to manage deliberately, especially when tools are used without clear limits or oversight.

One set of risks involves data quality and reliability. AI systems depend on large training datasets, and output quality often mirrors dataset quality.

Common challenges include:

- Time and cost associated with sourcing, cleaning, and maintaining datasets

- Inaccurate suggestions when training data doesn’t reflect real-world conditions

- Gaps around edge cases that fall outside common patterns

There are also limits to how well AI handles unfamiliar or complex situations. These tools perform best with well-defined tasks but can struggle in systems with tightly coupled components or highly specific business rules.

Transparency is another concern. AI-generated code doesn’t always make its reasoning clear, which can make inefficient logic or subtle errors harder to detect during review, especially when output looks superficially correct.

Operational dependency can introduce risk as well. Teams that build workflows around constant AI availability may see slowdowns if access changes, policies shift, or tools become unavailable.

Privacy and security remain ongoing considerations. Many AI systems process large volumes of data, raising questions around consent, sensitive information, and compliance. Teams typically address this through access controls, anonymization, encryption, and clear internal usage policies.

Dr. Soheyla Amirian, assistant professor of computer science at Seidenberg, frames the tension this way: “The opportunity lies in AI’s potential to revolutionize industries, improve efficiency, and solve global challenges. But it becomes a threat if not used ethically and responsibly. By fostering ethical frameworks and interdisciplinary collaboration, we can ensure AI serves as a tool for good, promoting equity and trust.”

Will We Still Need Software Developers in the Future?

As AI tools become more capable, questions about the future of software development are unavoidable. While AI can assist with implementation, several core responsibilities continue to depend on human expertise.

Areas where software developers remain essential include:

- System design and architecture. Developers make decisions about structure, scalability, integration, and long-term maintainability, i.e., work that requires understanding constraints and downstream impact.

- Context and continuity. Long-lived codebases reflect years of decisions and tradeoffs. Developers provide the historical and situational awareness needed to make safe changes.

- Review and refinement. AI-generated output often needs adjustment to meet performance expectations, security requirements, and team standards.

- Collaboration and problem-solving. Software development requires clarifying requirements, resolving ambiguity, and coordinating across roles. That work shapes what gets built and how it functions in practice.

Brian McKernan, PhD, assistant professor of communication and media studies at Pace’s Dyson College of Arts and Sciences, puts it simply, “There are great uses for AI, particularly in cases with huge amounts of data. But we will always need humans involved in verifying.”

Dr. James Brusseau, a Dyson faculty member and close collaborator with Seidenberg, echoes that perspective, stating, “AI, more than anything else, is just a tool. That is, I do not think it is capable of producing thought as you and I do.”

As AI takes on more routine programming tasks, the developer role shifts toward guiding decisions, evaluating outcomes, and staying accountable for what ships.

Skills Needed as a Software Developer in the Age of AI

With AI becoming a standard part of software development workflows, expectations for developers continue to expand. Strong programming foundations are still important, but today’s most effective engineers also combine AI literacy, data skills, cloud expertise, and the ability to collaborate and make strategic decisions.

Generative AI can accelerate coding and testing tasks, but it does not replace the need for developers who can design systems, evaluate risks, and guide projects from concept to deployment. That shift explains why technical depth, interpersonal skills, and decision-making are all becoming more important in AI-driven environments.

Gartner has projected that through 2027, generative AI will create new roles in software engineering and operations, requiring 80 percent of the engineering workforce to upskill.

Dr. Christelle Scharff reinforces this point, adding, “I believe that the big deal is that the tools related to AI are now in the hands of everybody, while earlier advances were confined and used by people in tech.”

Technical Skills

Modern software developers working with AI need a broad technical foundation that spans programming, data, infrastructure, and responsible system design.

- Programming and development:

- Proficiency in languages such as Python, R, Java, C++, or JavaScript

- Familiarity with AI frameworks and libraries like TensorFlow, PyTorch, Scikit-learn, and Keras

- Strong understanding of object-oriented programming and data structures

- AI and machine learning:

- Understanding of supervised, unsupervised, and reinforcement learning approaches

- Experience with natural language processing and computer vision applications

- Data skills:

- Ability to clean, analyze, and preprocess large datasets

- Experience working with structured and unstructured data

- Familiarity with databases and big data tools such as SQL, NoSQL, Hadoop, or Spark

- Cloud and DevOps:

- Experience with cloud platforms such as AWS, Google Cloud, or Azure

- Knowledge of DevOps practices and CI/CD pipelines for deploying and maintaining applications

- AI ethics and security:

- Understanding of AI bias, privacy concerns, and regulatory requirements

- Skills in designing secure and compliant AI-enabled systems

Interpersonal Skills

As AI automates portions of coding and testing, developers spend more time collaborating, translating requirements, and shaping how systems are built.

- Communication and collaboration:

- Explaining technical concepts to non-technical stakeholders

- Working effectively in cross-functional teams with product managers, designers, and data scientists

- Teamwork and knowledge sharing:

- Mentoring junior developers and reviewing code

- Contributing to shared standards and best practices

- Adaptability:

- Staying current with emerging tools and frameworks

- Adjusting quickly as project goals and technologies evolve

Decision-Making Skills

AI increases both the speed of development and the complexity of technical choices. Developers are increasingly responsible for guiding projects strategically and managing risk.

- Strategic thinking:

- Aligning AI initiatives with business objectives

- Identifying high-impact opportunities for AI integration

- Project management:

- Planning timelines, resources, and deliverables

- Using tools such as Jira, Trello, or Asana to track progress

- Risk management:

- Anticipating technical, ethical, and operational risks

- Ensuring compliance with security standards and regulatory requirements

These skill areas reflect how software development roles are changing alongside AI, where strong technical foundations are paired with collaboration, judgment, and system-level thinking.

6 In-Demand Software Developer Jobs That Use AI

Many roles now require AI experience. Some of the fastest-growing and highest-paying positions combine strong engineering foundations with experience building, integrating, or operating AI-enabled systems.

According to the U.S. Bureau of Labor Statistics (BLS), overall employment in computer and information technology occupations is projected to grow much faster than the average for all occupations from 2024 to 2034, with about 317,700 openings projected each year. Roles such as software developer and data scientist are among the occupations driving that momentum.

1. Machine Learning Engineer

Machine learning engineers build software systems that train, deploy, and monitor models in production. They work closely with application developers to integrate machine learning into real products and services.

- Typical education: Bachelor’s in computer science, software engineering, or related field; master’s often preferred

- Key skills: Python or Java, machine learning frameworks, data pipelines, model evaluation, deployment

- Salary (NYC): $136,000–$219,000 per year (median $172,000)

- Job outlook: 34 percent growth through 2034, much faster than average

2. AI Engineer

AI engineers design and implement AI-powered features inside applications, such as recommendation systems, automation tools, and intelligent interfaces. Their work connects models to APIs, cloud infrastructure, and user-facing systems within development workflows.

- Typical education: Bachelor’s in computer science or engineering; graduate study increasingly common

- Key skills: Software development, APIs, cloud platforms, AI model integration

- Salary (NYC): $135,000–$227,000 per year (median $174,000)

- Job outlook: 15 percent growth through 2034, well above average

3. Data Scientist

Data scientists build analytical pipelines and machine learning models that support software products and data-driven platforms. They collaborate closely with software developers to move models from experimentation into production.

- Typical education: Bachelor’s in a quantitative field; master’s often preferred

- Key skills: Statistics, machine learning, SQL, Python or R, data visualization

- Salary (NYC): $127,000–$217,000 per year (median $165,000)

- Job outlook: 34 percent growth through 2034, among the fastest-growing tech roles

4. AI Research Scientist

AI research scientists develop new algorithms and learning approaches that later become part of commercial software systems, platforms, and developer tools.

- Typical education: Master’s degree or PhD in AI, computer science, or related field

- Key skills: Advanced mathematics, ML theory, experimentation, research

- Salary (NYC): $165,000–$256,000 per year (median $204,000)

- Job outlook: 20 percent growth through 2034, significantly faster than average

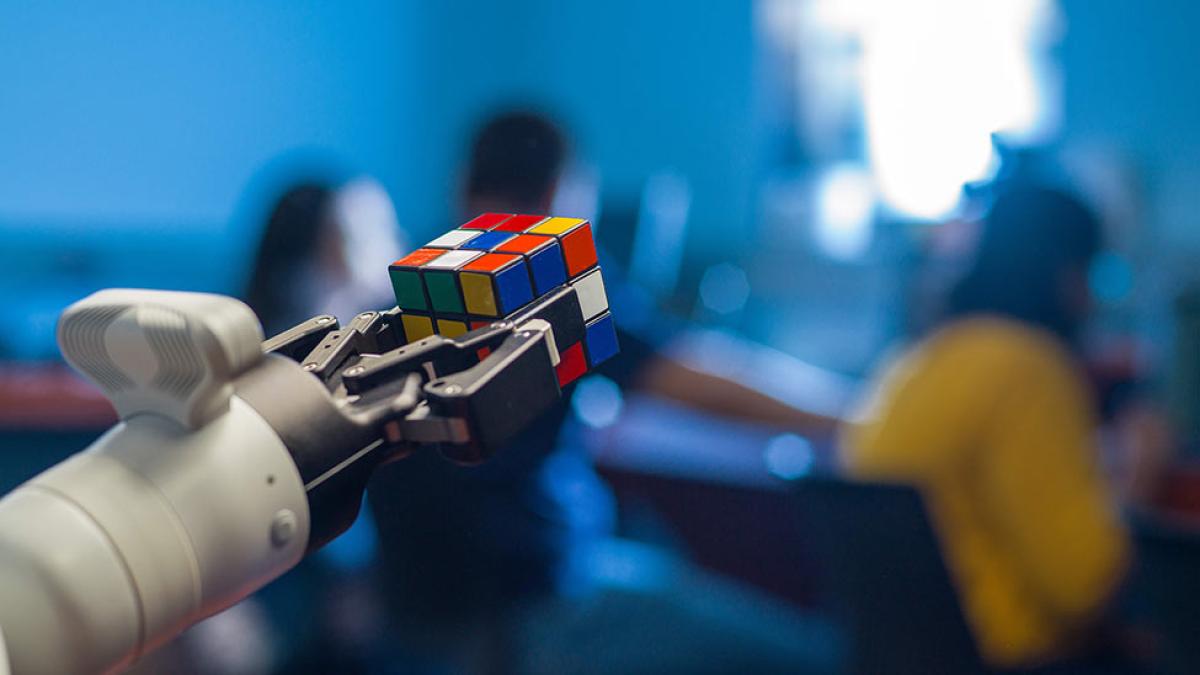

5. Robotics Engineer

Robotics engineers write and maintain the software that controls automated systems, sensors, and intelligent machines. They combine software development with AI-driven perception and control to operate in physical environments.

- Typical education: Bachelor’s in engineering or computer science; advanced degrees common

- Key skills: Embedded systems, controls, AI integration, hardware/software coordination

- Salary (NYC): $110,000–$184,000 per year (median $141,000)

- Job outlook: 9 percent growth through 2034, faster than average

6. AI Product Manager

AI product managers guide the development of AI-powered software products, translating business goals into technical requirements and working with engineering teams through build, testing, and deployment.

- Typical education: Bachelor’s degree; many roles favor a master’s in technology or business

- Key skills: Product strategy, technical communication, AI fundamentals, stakeholder coordination

- Salary (NYC): $173,000–$262,000 per year (median $211,000)

- Job outlook: 15 percent growth through 2034, showing strong demand across tech leadership roles

Bonus: Software Developers (General)

Software developers design, build, test, and maintain applications and systems across industries, increasingly incorporating AI tools, automation, and machine learning into modern software architectures.

- Typical education: Bachelor’s in computer science or related field

- Key skills: Programming, system design, debugging, collaboration

- Salary (NYC): $108,000–$178,000 per year (median $138,000)

- Job outlook: 15 percent growth through 2034, much faster than average

Note: Salary figures are based on Glassdoor data collected in January 2026. Actual compensation may vary over time and can fluctuate based on factors such as location, employer, experience level, industry, and the number of reported salary submissions.

Overall Job Outlook for AI-Driven Software Careers

Employment across computer and information technology occupations is projected to grow much faster than average over the next decade. Expanding use of artificial intelligence, cloud computing, automation, cybersecurity, and data-driven systems continues to drive demand for professionals who can design, build, and manage modern software environments.

For a closer look at career options in AI-related fields, Pace’s program pages for the MS in Artificial Intelligence, MS in Applied Artificial Intelligence, and BS in Artificial Intelligence include detailed career outcome information.

FAQ

What is AI in software development?

AI in software development refers to using machine learning systems to support tasks such as writing code, testing software, debugging, and reviewing changes. These tools analyze patterns in existing code and data, while developers remain responsible for design decisions, validation, and deployment.

How can AI be used in software development?

Common uses of AI in software development include generating code drafts, creating or expanding test coverage, spotting potential bugs, generating images and visual assets, flagging security risks, summarizing changes for reviews, and supporting debugging workflows.

What is an AI software developer?

An AI software developer is a developer who builds, integrates, or works alongside AI-driven systems. This can include developing machine learning models, embedding AI services into applications, or using AI tools to support development workflows.

Is AI replacing software developers?

AI is not replacing software developers. It is changing how development work is distributed by handling routine tasks and generating drafts, while developers continue to guide design, review output, and manage complexity in production systems.

Can AI do coding?

AI can generate, refactor, and suggest code based on learned patterns. It does not independently understand business requirements, system constraints, or long-term impact. Developers must review and adapt AI-generated code to ensure it works correctly within a broader system.

What jobs will AI replace?

AI is more likely to automate specific tasks rather than fully replace most technology roles. Repetitive, narrow-scope work such as basic code translation, routine testing, or simple script generation is increasingly handled by AI tools. However, roles that involve system design, problem-solving, collaboration, and oversight continue to grow as organizations adopt AI across software development.

Which jobs will not be replaced by AI?

Roles that require system-level thinking, human judgment, and accountability are far less likely to be fully replaced by AI. This includes software architects, senior developers, security and infrastructure leaders, platform engineers, and technical product roles that guide design decisions, manage risk, and take responsibility for real-world system performance.

Looking Ahead

AI has become part of how software is built, but it hasn’t removed the need for people who can design systems, make decisions, and take responsibility for outcomes. For students weighing graduate education, preparation focuses on building those capabilities alongside technical depth.

Pace’s Seidenberg School has been teaching and researching AI for over 30 years. Faculty like Dr. Christelle Scharff, co-director of the Pace AI Lab, and Dr. Soheyla Amirian lead research across healthcare AI, computer vision, and ethical AI frameworks. Students work alongside these researchers through lab projects, hackathons, and industry partnerships. To learn more, read about Seidenberg’s legacy of AI excellence or explore how faculty are powering student discovery.

To explore how Pace approaches that preparation, you can review the Master of Science in Software Development and Engineering program options:

- MS in Software Development and Engineering, on-campus format

- MS in Software Development and Engineering, online format

If you’d like to talk with an admissions counselor about fit, timelines, and prerequisites, you can also request information anytime.

Emerging Tech Careers: The Most In-Demand Jobs for the Future

Discover the most in-demand tech jobs in the New York area and beyond for 2026 and the future.

Fewer industries have seen as much upheaval and transformation over the past few years as the tech industry. Topics such as artificial intelligence, machine learning, deep learning, and data analytics aren’t limited to the field of IT, but are now intrinsic to every field and industry, from finance and higher education to healthcare and manufacturing.

There are incredible opportunities out there for tech jobs, both now and in the future, but understanding which careers are available and how to qualify for them can be challenging. If you’re looking for information on the most in-demand tech jobs and best career opportunities, keep reading.

Career Outlook for Tech Industry Jobs

Employment in the tech industry remains strong, as technology roles are still among the most in-demand career paths. While it is true that recent years have seen increased layoffs and the rapid rise of AI has reshaped the tech job market, the effects have been strongest on entry-level jobs, but the long-term outlook for skilled positions continues to be positive. What we’re seeing is that, as AI technologies become integrated across industries, the need for skilled and ethical AI professionals is expected to increase significantly.

According to the Bureau of Labor Statistics (BLS), computer and IT occupations are projected to grow by 11.7 percent, much faster than average from 2023 to 2033, with an estimated 317,700 openings each year. This reflects a steadier and sustainable demand compared to the overhiring that characterized 2021–2022. Roles such as software developers and database architects, which are foundational to AI infrastructure, are expected to grow by 17.9 percent and 10.8 percent, respectively.

Even as the tech sector adjusts, the need for digital expertise is expanding across industries. CBRE’s Scoring Tech Talent report notes that in 2023, the tech industry added nearly 29,000 jobs, while AI-related positions grew at twice that rate. Beyond the tech sector itself, professional and business services added nearly 50,000 positions, and transportation, warehousing, and wholesale industries added about 45,000 roles.

It is the growing skills gap that poses one of the biggest challenges for employers. An IDC survey of IT leaders projects that by 2026, the global IT skills shortage could cost organizations $5.5 trillion. Staffing firm Robert Half found that 89 percent of technology recruiters report difficulty finding candidates with the right mix of skills. In particular, employers are seeking:

- AI expertise to design and implement solutions

- Data science skills to generate insights from complex data

- IT operations and support to maintain digital infrastructure

- Cybersecurity knowledge to protect against evolving threats

- Process automation skills to streamline business operations

Looking ahead, the World Economic Forum identifies AI, big data, networks, and cybersecurity as the fastest-growing technical skills. Equally important are human-centered skills such as creative thinking, adaptability, curiosity, and lifelong learning—all of which help professionals thrive in a rapidly changing field.

For tech-savvy professionals who can demonstrate those skills, the potential is immense, especially in hubs like New York City, where innovation and opportunity converge.

Top 2 In-Demand Careers in Tech

Based on those current trends, it’s clear that the biggest need will be for tech professionals who possess specialized technical skills and can showcase higher-level critical thinking and adaptability skills. These twenty careers are the ones most listed as in-demand according to the BLS and job aggregate sites.

All the jobs are listed according to expected salary ranges, sourced from Glassdoor for the New York Metro area, and are divided into three categories:

- Advanced Leadership Roles: These leadership pathways are often the highest paying and require the most experience.

- High-Growth Technical Roles: These current-edge roles showcase high-demand specialties ideal for those investing in new technical expertise.

- Solid Foundational Roles: These essential positions are ideal for new graduates and pivoters seeking reliable entry points into tech.

Advanced Leadership Roles

1. Principal Software Engineer — $227,000–$359,000+

Principal software engineers are the senior-most engineers on a project, acting as both technical architects and mentors. They set the vision for software systems, establish coding standards, and guide teams in solving high-level challenges. In this capacity, they work above mid- and senior-level software engineers, collaborate with DevOps engineers and site reliability engineers to ensure scalability, and often partner with product managers to align technical strategy with business goals.

General Responsibilities:

- Designing the overall system architecture for complex applications

- Reviewing and approving technical decisions made by other engineers

- Coordinating with leaders across teams to align software with organizational objectives

Alternative Titles: Lead Software Engineer, Software Architect

Relevant Degrees: MS in Software Development & Engineering, MS in Computer Science

Recommended Skills: Systems design, leadership, architecture frameworks, advanced coding

2. AI Product Manager — $153,000–$230,000+

AI product managers bridge artificial intelligence technology with business outcomes. They translate complex AI capabilities into usable products while setting strategy and roadmaps. They sit at the intersection of technology, business, and design, working alongside data scientists and machine learning engineers to understand feasibility, and partnering with business analysts and executives to ensure AI products meet both ethical standards and market needs.

General Responsibilities:

- Defining the roadmap for AI-driven products

- Prioritizing features and coordinating development and launches

- Ensuring compliance and ethical use of AI technologies

Alternative Titles: Machine Learning Product Owner, Technology Product Manager

Relevant Degrees: MBA, MS in Computer Science or MBA in Business Analytics

Recommended Skills: AI/ML literacy, product strategy, data analysis, stakeholder communication

3. IT Manager — $105,000–$179,000

IT managers oversee the technology infrastructure of an organization, balancing leadership with technical oversight. They manage teams of network administrators and database administrators, while coordinating closely with cybersecurity engineers to safeguard systems. They also serve as liaisons to executives and business units, ensuring that technology resources align with organizational goals and compliance standards.

General Responsibilities:

- Supervising IT staff and overseeing daily operations

- Managing system upgrades, security patches, and IT budgets

- Developing policies and ensuring regulatory compliance

Alternative Titles: IT Director, Technology Operations Manager

Relevant Degrees: MS in Information Systems or MBA in Information Systems

Recommended Skills: Leadership, IT strategy, project management, budgeting, systems oversight

4. Product Manager — $119,000–$207,000

Product managers own the lifecycle of a product from conception to launch. They direct what gets built, balancing customer needs with technical feasibility and business goals. They collaborate with engineers, designers, and analysts to deliver solutions while ensuring that priorities remain aligned with strategy. They work closely with product designers on user experience, software engineers on implementation, and data analysts on measuring performance.

General Responsibilities:

- Conducting market research and defining user personas

- Leading feature prioritization and sprint planning

- Monitoring product performance post-launch and adapting strategy

Alternative Titles: Technical Product Manager, Product Owner

Relevant Degrees: MBA, MS in Information Systems, MS or MBA in Business Analytics

Recommended Skills: Agile methods, product strategy, research, leadership

5. Product Designer — $87,000–$149,000

Product designers focus on creating digital products that are both functional and visually appealing, blending user experience (UX) with user interface (UI) design. They often collaborate with product managers to align design with strategy, work closely with web and mobile developers to translate designs into code, and draw on insights from data and business analysts to refine and improve product usability.

General Responsibilities:

- Conducting user research and usability testing

- Developing wireframes, prototypes, and design systems

- Collaborating with engineers to ensure seamless implementation

Alternative Titles: UX Designer, UI Designer, Experience Designer

Relevant Degrees: BS in Digital Design, MS in Human-Centered Design

Recommended Skills: Prototyping, design systems, Figma, user research, creative thinking

High-Growth Technical Roles

6. Machine Learning Engineer — $133,000–$215,000

Machine learning engineers develop and deploy AI models that enable software and systems to learn from data. They work closely with data scientists, who design the initial algorithms, and with software engineers to integrate models into applications. Their role ensures that artificial intelligence solutions move beyond research into practical, scalable products.

General Responsibilities:

- Building and training machine learning models

- Optimizing algorithms for performance and accuracy

- Deploying models into production environments

- Collaborating with teams to refine AI applications

Alternative Titles: AI Engineer, Deep Learning Engineer

Relevant Degrees: MS in Data Science, MS in Computer Science, MS in Artificial Intelligence

Recommended Skills: Python, TensorFlow/PyTorch, algorithms, data modeling

7. Data Scientist — $124,000–$210,000

Data scientists turn raw data into actionable insights that guide business and product decisions. They create predictive models, run experiments, and communicate findings to stakeholders. They often rely on data engineers to provide clean, structured data pipelines and collaborate with analysts to translate technical results into business context.

General Responsibilities:

- Designing and implementing statistical models

- Conducting experiments and A/B testing

- Communicating insights through reports and visualization

- Advising leadership on data-driven strategies

Alternative Titles: Machine Learning Scientist, Quantitative Analyst

Relevant Degrees: MS in Data Science, MS in Business Analytics, PhD in Computer Science

Recommended Skills: Statistics, ML, R/Python, SQL, visualization

8. Cybersecurity Engineer — $130,000–$210,000

Cybersecurity engineers design defenses to protect systems, networks, and data from cyber threats. They often collaborate with IT managers and network administrators to secure infrastructure and with information security analysts who monitor for breaches. Their work ensures that organizations remain resilient against increasingly sophisticated cyberattacks.

General Responsibilities:

- Implementing and testing security measures

- Conducting vulnerability assessments and penetration testing

- Monitoring for and responding to incidents

- Ensuring compliance with regulatory standards

Alternative Titles: Security Architect, Information Security Engineer

Relevant Degrees: BS in Cybersecurity, MS in Cybersecurity

Recommended Skills: Threat detection, penetration testing, compliance, incident response

9. DevOps Engineer — $125,000–$197,000

DevOps engineers streamline collaboration between development and operations teams by automating the software lifecycle. They frequently work with software engineers on code integration and with cloud engineers and site reliability engineers to build scalable, resilient infrastructure. Their role ensures products are delivered quickly and reliably.

General Responsibilities:

- Building and maintaining CI/CD pipelines

- Automating deployment and infrastructure processes

- Managing containers and orchestration tools

- Monitoring applications and resolving deployment issues

Alternative Titles: Platform Engineer, Release Engineer

Relevant Degrees: MS in Information Systems, MS in Computer Science

Recommended Skills: CI/CD, cloud infrastructure, containerization, scripting

10. Cloud Engineer — $134,000–$221,000

Cloud engineers design, implement, and manage cloud-based systems that support scalable, secure operations. They often collaborate with DevOps engineers and site reliability engineers to optimize infrastructure, and with IT managers to ensure alignment with broader organizational strategies.

General Responsibilities:

- Deploying and managing cloud environments such as Amazon Web Services (AWS) and Google Cloud Platform (GCP)

- Configuring cloud security and compliance controls

- Automating backups and disaster recovery systems

- Supporting hybrid or multi-cloud strategies

Alternative Titles: Cloud Architect, Cloud Infrastructure Engineer

Relevant Degrees: MS in Enterprise Analytics, MS in Information Systems

Recommended Skills: AWS/Azure/GCP, Kubernetes, virtualization, automation

11. Site Reliability Engineer (SRE) — $140,000–$220,000

Site reliability engineers combine software engineering expertise with IT operations to keep large-scale systems stable and reliable. They often collaborate with software engineers to design resilient systems, with DevOps teams to automate processes, and with IT managers to minimize downtime.

General Responsibilities:

- Automating system monitoring and incident response

- Building tools to improve system reliability

- Investigating and resolving outages

- Defining service-level agreements (SLAs)

Alternative Titles: Infrastructure Reliability Engineer, Reliability Engineer

Relevant Degrees: MS in Computer Science, MS in Information Systems

Recommended Skills: Monitoring, automation, coding, cloud platforms

12. Data Engineer — $112,000–$187,000

Data engineers create and maintain the pipelines and architectures that make large-scale data usable. They work directly with data scientists, providing clean, structured data, and with database administrators who ensure secure storage and retrieval. Their work is the backbone of any data-driven organization.

General Responsibilities:

- Designing and maintaining ETL (extract, transform, load) processes

- Optimizing data storage and retrieval for analytics

- Managing distributed systems like Hadoop and Spark

- Ensuring data reliability and availability

Alternative Titles: ETL Developer, Data Infrastructure Engineer

Relevant Degrees: MS in Data Science, MS in Information Systems

Recommended Skills: SQL, Spark/Hadoop, ETL, Python/Scala

13. Information Security Analyst — $113,000–$185,000

Information security analysts monitor systems for breaches, enforce security policies, and respond to incidents. They typically report to cybersecurity engineers or IT managers and provide the first line of defense. Their work connects to broader cybersecurity strategies while handling day-to-day risk mitigation.

General Responsibilities:

- Monitoring networks for unusual activity

- Investigating and reporting security incidents

- Enforcing organizational policies and compliance requirements

- Running security audits and vulnerability scans

Alternative Titles: SOC Analyst, Risk Analyst

Relevant Degrees: BS in Cybersecurity, MS in Cybersecurity

Recommended Skills: Threat monitoring, IDS/IPS, compliance frameworks

Solid Foundational Roles

14. Software Engineer — $129,000–$210,000 (entry to senior)

Software engineers design, code, and maintain applications that serve users and businesses. They collaborate with product managers to translate requirements into features, with DevOps engineers to ensure smooth deployment, and with QA testers to validate functionality. Their work is central to nearly every digital product.

General Responsibilities:

- Writing and testing code in languages like Java, Python, or C++

- Debugging and maintaining applications

- Collaborating on design and development teams

- Contributing to system documentation

Alternative Titles: Software Developer, Application Developer

Relevant Degrees: BS in Computer Science, BS in Software Engineering

Recommended Skills: Programming (Java, Python), debugging, collaboration

15. Web Developer — $82,000–$143,000

Web developers build websites and web applications that power online experiences. They often collaborate with product designers to ensure usability and with software engineers to integrate back-end systems. Their work directly shapes how users interact with digital products.

General Responsibilities:

- Writing code with HTML, CSS, and JavaScript frameworks

- Creating responsive, mobile-friendly layouts

- Testing and maintaining site performance

- Ensuring accessibility and security standards

Alternative Titles: Front-End Developer, Back-End Developer

Relevant Degrees: BS in Computer Science, BS in Information Systems

Recommended Skills: HTML/CSS/JavaScript, React/Angular, responsive design

16. Mobile Application Developer — $113,000–$177,000

Mobile developers create apps for iOS and Android devices. They work closely with product designers to refine user experiences and with software engineers to integrate mobile features with larger systems. Their work ensures that mobile applications are functional and maintain performance while on the go.

General Responsibilities:

- Developing apps with Swift, Kotlin, or cross-platform tools

- Testing and debugging across devices

- Optimizing app performance and usability

- Releasing updates and new features

Alternative Titles: iOS Developer, Android Developer

Relevant Degrees: BS in Computer Science, BS in Software Development

Recommended Skills: Swift, Kotlin, cross-platform frameworks

17. Data Analyst — $74,000–$125,000

Data analysts interpret and present data to guide decisions. They collaborate with data engineers to access structured data and with business analysts to connect findings to organizational needs. Their role often serves as a stepping stone toward data science or business intelligence careers.

General Responsibilities:

- Collecting and cleaning datasets

- Running statistical analyses

- Building dashboards and reports in tools like Tableau or Power BI

- Presenting insights to stakeholders

Alternative Titles: Business Intelligence Analyst, Reporting Analyst

Relevant Degrees: MS in Data Science, MS in Business Analytics

Recommended Skills: SQL, Excel, Tableau/Power BI, critical thinking

18. Business Analyst — $85,000–$141,000

Business analysts translate organizational needs into technology requirements. They collaborate with IT managers, product managers, and engineers to ensure solutions align with business goals. Their work connects strategic objectives with technical implementation.

General Responsibilities:

- Gathering and documenting business requirements

- Mapping workflows and identifying improvement opportunities

- Communicating needs between business and technical teams

- Supporting project management with requirements validation

Alternative Titles: Systems Analyst, Requirements Analyst

Relevant Degrees: MS in Information Systems, MBA

Recommended Skills: Process modeling, requirements gathering, communication

19. Network Administrator — $83,000–$139,000

Network administrators manage the systems and networks that keep organizations connected and operational. They often support IT managers in maintaining infrastructure, collaborate with cybersecurity engineers to secure access, and work alongside system administrators on hardware and server maintenance.

General Responsibilities:

- Configuring and monitoring LANs/WANs

- Troubleshooting network performance issues

- Managing firewalls and VPNs

- Performing routine backups and updates

Alternative Titles: Systems Administrator, Network Engineer

Relevant Degrees: BS in Information Technology, BS in Cybersecurity

Recommended Skills: Networking protocols, troubleshooting, firewalls

20. Database Administrator (DBA) — $87,000–$148,000

Database administrators maintain and secure databases to ensure reliability and accessibility. They collaborate with data engineers who design pipelines and with data analysts who query systems. Their work supports both day-to-day business operations and long-term data strategy.

General Responsibilities:

- Managing database access and permissions

- Optimizing queries and performance tuning

- Backing up and restoring data

- Ensuring security and compliance standards

Alternative Titles: Database Engineer, SQL Administrator

Relevant Degrees: MS in Information Systems, MS in Data Science

Recommended Skills: SQL, backup management, database design, tuning

How to Prepare for a Career in Tech

The most in-demand tech jobs can be highly competitive. To give yourself the best chance of success, follow the advice below:

- Build your practical and technical skills

It’s your specific skill that will set you apart, so be sure to understand and master the fundamentals of programming, data analysis, and digital systems specific to the career you’re interested in. Build your skills through advanced master’s degree programs, such as those offered by the Seidenberg School of CSIS. Use online platforms, open-source projects, or personal coding challenges to strengthen problem-solving abilities. - Earn a certification and/or advanced degree

Industry certifications (such as AWS, CompTIA, or CISSP) showcase specialized expertise. Earning an advanced degree, such as a master’s in computer science, data science, or cybersecurity, not only deepens your technical knowledge but also opens doors to leadership opportunities. - Build a network and learn about the industry

Networking is critical in tech. Attend conferences, join professional associations, and connect with alumni. Following thought leaders and industry news helps you stay ahead of emerging trends, technologies, and hiring opportunities. Take advantage of opportunities to connect with industry leaders and build experience within the workplace. - Develop your soft skills and critical thinking

Above all else, tech professionals are problem-solvers. Communication, teamwork, adaptability, and critical thinking are essential, as employers want individuals who can explain complex solutions clearly and adapt quickly to change. Give yourself an advantage by ensuring that the curriculum of your degree program offers more than just technical training, but also opportunities to work with and collaborate with others to create solutions. - Get practical experience through internships or bootcamps

Hands-on experience is one of the best ways to prepare for a tech career. Internships, bootcamps, and project-based learning provide opportunities to apply knowledge in real-world settings and build a professional portfolio. Look for opportunities to practice your skills in state-of-the-art facilities, such as AI labs, design factories, and research labs.

Building your skills and experience now is essential for staying ahead of the tech job curve. Dr. Christelle Scharff, Ph.D., professor and director of the Artificial Intelligence Lab at Seidenberg, has employed her own expertise in AI research and innovation to prepare students for future tech careers. She explains that work will only continue to grow in importance, as “I’ve seen firsthand the growing interest and need for AI education at every level.”

That commitment to future student success is echoed by Dr. Jonathan H. Hill, DPS, Chief Transformation Officer and Executive Vice President at Pace. When asked about how Seideberg is preparing students for future tech careers, Dr. Hill states, “We are not only developing industry-ready graduates—we are also building leaders who will shape how AI is implemented, understood, and governed.”

“We are not only developing industry-ready graduates—we are also building leaders who will shape how AI is implemented, understood, and governed.”

FAQ

Which tech job is highest in demand?

Software engineers and data scientists are two of the most in-demand tech roles, with strong hiring across industries. Cloud engineers and cybersecurity specialists are also rapidly growing due to the shift toward cloud systems and the need for digital security. According to Bureau of Labor Statistics projections, jobs for information security analysts are especially strong and are expected to grow 32% from 2022 to 2032.

Which IT field has the highest salary?

Artificial intelligence currently leads the salary outlook. Roles such as AI engineers, machine learning specialists, and AI architects consistently command top pay, often well into the $180,000–$250,000+ range, reflecting the critical demand for advanced AI expertise.

Which tech jobs make 6 figures?

Most mid- to senior-level roles in software engineering, data science, machine learning, cloud computing, and cybersecurity earn six-figure salaries. Leadership positions like product managers, IT managers, and principal engineers can reach $150,000+ annually.

What tech skill pays the most?

AI and machine learning expertise currently top the list, followed by advanced data science and cloud architecture. These skills drive innovation and efficiency, making professionals who master them highly competitive in today’s job market.

If you’re looking to advance into a tech or IT career, Pace University offers multiple master’s programs to help you achieve your goals. Choose from among our Computer Science, Cybersecurity, Data Science, Information Systems, Human-Centered Design, and Software Development and Engineering master’s programs.

Many of our programs are also available online, including Computer Science, Cybersecurity, Data Science, Information Systems, and Software Development and Engineering.

If you’re interested in working at the cutting edge of tech research, Pace also offers a PhD in Computer Science. Contact us to learn more about our programs and find the right fit for your career goals.

Torres Forum Tackles Big Beautiful Bill’s Graduate Loan Changes

In higher education policy coverage, Assistant Vice President for Public Affairs Sean Coughlin tells The Riverdale Press that proposed federal limits on graduate student borrowing could push more students toward private loans with higher interest rates and fewer consumer protections.

New York Judge Rules Intentionally Transmitting STD to Partner Constitutes Domestic Violence

Haub Law Professor Morghan Richardson speaks to the New York Post on the recent New York court ruling that intentionally transmitting a sexually transmitted disease to a spouse can constitute domestic violence. Professor Richardson describes the decision as a significant legal development and a potential landmark moment for domestic violence jurisprudence.

The Little-Known Committee That Has Cost Black Farmers for Generations

In coverage examining the impact of a little-known U.S. Department of Agriculture committee on Black farmers, Haub Law Professor Josh Galperin tells Capital B that democratic participation requires more than elections alone, emphasizing the importance of transparency, open discussion, and equitable participation in government advisory processes — and Yahoo News has the story.

Drop the $10 Billion Lawsuit Against The IRS, Mr. President | Opinion

Lubin Professor Philip Cohen writes a piece in The Journal News urging President Trump to drop a $10 billion lawsuit against the IRS. Cohen argues the case risks politicizing tax administration and undermining public confidence in federal institutions. The column was widely syndicated across several regional outlets.

The Looming Threat to Prison Oversight: Now is Not the Time to Step Back

Haub Law Professor Emeritus Michael Mushlin co-authors an op-ed in the New York Law Journal warning against proposed cuts that would eliminate funding for the Correctional Association of New York—the state’s only independent prison oversight body. The authors argue that oversight is critical amid rising prison deaths, staffing shortages, and instability, writing that accountability mechanisms are essential safeguards against abuse and neglect.

Pace University Celebrates Opening of Gale Epstein Center for Technology in Pleasantville

News 12 covered the opening of the Gale Epstein Center for Technology, marked by a ribbon-cutting ceremony on campus. The center includes a new environmental data laboratory designed to monitor conditions in the Hudson Valley and support technology-focused research and learning, made possible through a gift from philanthropist and business leader Gale Epstein—and Hispanic Business TV has the story.

Colleges See Spike in Students With Disabilities, Including Elite Schools

The New York Times highlights Pace University’s leadership in supporting students with disabilities. Director of Student Accessibility Services Elisse Geberth said Pace has worked intentionally to create a more supportive accommodations process, shifting away from systems where students must “fight” for services toward one centered on partnership and access. Jennifer Pankowski, Education Professor and Director of OASIS, was also interviewed, noting that institutions are increasingly recognizing disability access as essential to student success rather than an exception.

Press Release: Three Sands College of Performing Arts Faculty Members Earn Prestigious National Musical Theatre Writing Honors

Pace University’s Sands College of Performing Arts faculty members Eric Price, Phillip Christian Smith, and Adam J. Rineer have earned major national recognition in musical theatre writing, with Price and Smith named 2026 Kleban Prize winners and Rineer selected as a 2026 Jonathan Larson Grant recipient.

Two 2026 Kleban Prize Winners and One Jonathan Larson Grant Recipient Recognized for National Artistic Excellence

Pace University’s Sands College of Performing Arts faculty members Eric Price, Phillip Christian Smith, and Adam J. Rineer have earned major national recognition in musical theatre writing, with Price and Smith named 2026 Kleban Prize winners and Rineer selected as a 2026 Jonathan Larson Grant recipient.

“To have three faculty members recognized in the same year with two of the most distinguished honors in musical theatre writing is extraordinary,” said Jennifer Holmes, PhD, dean of Sands College of Performing Arts. “These awards reflect the creative leadership and artistic rigor of our faculty and affirm Sands College as a center for innovation in musical theatre.”

The Kleban Prize

Price received the 2026 Kleban Prize for Most Promising Lyricist in Musical Theatre, and Smith received the 2026 Kleban Prize for Most Promising Librettist in Musical Theatre. Each will receive $100,000, distributed over two years through The Kleban Foundation.

Established in 1988 in the will of A Chorus Line lyricist Edward Kleban, the prize supports writers of extraordinary promise and is awarded in recognition of future artistic achievement. The Kleban Prize is administered by New Dramatists on behalf of The Kleban Foundation.

Phillip Christian Smith teaches verse and heightened language in the BFA Acting program. An award-winning playwright, he has been recognized by the O’Neill National Playwrights Conference, The Dramatists Guild Fellowship, New Dramatists, PlayPenn, and The Playwrights Realm. His play The Chechens received its fourth production at Pace in fall 2022, directed by the playwright.

Smith holds an MFA from Yale School of Drama, an MFA from Hunter College (’23), and a BFA from the University of New Mexico. He has acted at theaters nationwide, including Hartford Stage, Milwaukee Repertory Theater, The Shakespeare Theatre of New Jersey, and The Public Theater’s Shakespeare in the Park, and is currently developing a Sloan Commission.

“I like to start out by thanking the great Edward Kleban for thinking about the future of the American Theatre in creating this award knowing that lyricists and book writers would probably be working in cafés, and coffee shops, restaurants and bars, office jobs, and also in this case adjuncts,” said Smith.

Eric Price is a lyricist, librettist, director, and educator who previously received the Fred Ebb Award for Musical Theatre Writing with collaborator Will Reynolds. His work includes the musicals The Violet Hour, Presto Change-o, Radioactive, Hello Out There, Around the World, and The Sixth Borough, as well as additional material for the stage adaptation of Clue, which has toured nationally and internationally and is among the most produced plays worldwide. The Violet Hour released an all-star studio cast album that was named Best Cast Album of the Year by the Broadway Radio Show.

Price worked for many years alongside 21-time Tony Award–winning director and producer Hal Prince on the development of new musicals. He holds an MFA in Musical Theatre Writing from NYU’s Tisch School of the Arts and has taught musical theatre history, repertoire, and writing at Pace for nine years. He also serves on the faculty of CAP21.

“The work of Edward Kleban has always been an incredible source of inspiration for me,” said Price. “It’s a privilege to be part of his amazing legacy, as well as share this experience with the truly wonderful writers who have received this award before. I’m profoundly grateful.”

Jonathan Larson Grant

The Jonathan Larson Grant, administered by the American Theatre Wing and sustained by the Jonathan Larson Performing Arts Foundation, is an unconditional annual investment in emerging musical theatre composers, lyricists, and librettists. Named for the Pulitzer Prize–winning creator of Rent, the grant supports artists with the potential to shape contemporary culture and advance the future of the American musical.

Adam J. Rineer is a composer, writer, and music director dedicated to new musical theatre development. Currently an Artist in Residence at Ars Nova and a member of The Civilians’ R&D Group, Rineer has developed work presented at HERE Arts Center, Musical Theatre Factory, National Alliance for Musical Theatre, and the Eugene O’Neill National Musical Theatre Conference. They are also the co-founder of the UNTITLED Musical Project, supporting marginalized musical theatre writers.

Rineer earned an MFA in Musical Theatre Collaboration from Temple University as part of the inaugural George and Joy Abbott Musical Theatre cohort and holds a BA in music from Millersville University. They are members of The Dramatists Guild and ASCAP.

“It’s an incredible honor to receive this award in the named of one of my musical theatre hero’s, Jonathan Larson — an artist who pushed boundaries in genre and form,” said Rineer. “His legacy continues to inspire writers, including myself, to take creative risks and tell urgent stories. With the help of this grant, I look forward to continuing to explore how I can live up to his legacy.”

Amanda Flynn, Ed.D., program head of musical theatre, noted that the recognition reflects the strength of the program’s faculty and its commitment to new work development.

“Our students are learning directly from artists who are shaping the future of the American musical,” Flynn said. “Having faculty recognized with the Kleban Prize and the Jonathan Larson Grant reinforces the depth of mentorship and artistic excellence embedded in our program.”

Together, the Kleban Prize and the Jonathan Larson Grant represent two of the most significant national honors for musical theatre writers, underscoring Pace University’s leadership in shaping the future of the American musical.

About Pace University

Founded in 1906 and celebrating 120 years of preparing students for success in 2026, Pace University pairs real-life learning with strong academics to launch meaningful careers. With campuses in New York City and Westchester County, Pace serves 13,600 students across a range of bachelor, master, and doctoral programs through the College of Health Professions, Dyson College of Arts and Sciences, Elisabeth Haub School of Law, Lubin School of Business, Sands College of Performing Arts, School of Education, and Seidenberg School of Computer Science and Information Systems.

About Sands College of Performing Arts

Sands College of Performing Arts at Pace University is a cutting-edge performing arts school that nurtures artistic innovation and develops future leaders and changemakers in the profession. Renowned for its diverse range of highly-ranked programs, Sands College is committed to cultivating top-talent performers, designers, and production professionals. From Hollywood to Broadway, Sands College students and alumni have appeared in major film and television productions and theater performances such as & Juliet, A Beautiful Noise, A Strange Loop, Almost Famous, Hadestown, Hamilton, Kimberly Akimbo, MJ The Musical, Moulin Rouge, Ohio State Murders, Wicked, and the Radio City Christmas Spectacular. Recognized by Playbill as one of the 10 most represented colleges on Broadway, Sands College continues to inspire the next generation of artists both on stage and screen.